|

||||

|

||||

|

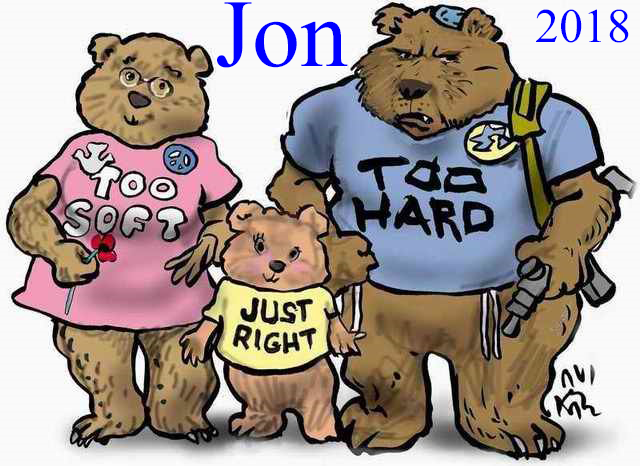

| [jon_spain] [TPR_DB_2020] |

|

On 03 March 2020, TPR (the UK pensions regulator) issued a consultation paper about how defined benefit pension scheme funding should be regulated. Due to Covid, the final submissions date was postponed until 02 September 2020. As I see it, the existing funding regulations are unfit for purpose. However, the proposed funding code would make a bad situation very much worse. My personal submission is here and my previous submission 2017 DWP is here. Before I published the submission here, it was kindly hosted by Henry Tapper. In relation to section “L” {Evidence (Accompanying GAD Report) : Personal Views}, one contributor asked if I had seen the update paper from GAD dated 11 August 2020, which TPR shared before the Bank Holiday? Well, I hadn’t but I finally tracked it down. Unlike the original paper from GAD dated 14 February 2020, the correlations between different returns are shown as are some return statistics. However, the numbers are somewhat surprising. For example, the same mean return of 5.3% pa over 10 years is expected on 3 different assets, with hedging not being explained. Further, the correlations between Global Equity (ex UK) “hedged”, hedge funds (US) and global corporate bonds seem remarkably high. In my view, the other omissions from the initial report remain.

|